November 2017 Income At-A-Glance

Gross Income for November: $208,971

Total Expenses for November: $54,375

Total Net Profit for November: $154,596

Difference b/t November & October: -$7,339

Free and amazing trainings!

Free Podcast Course: Learn how to create and launch your podcast!

Your Big Idea: Discover Your Big Idea in less than an hour!

Entrepreneurs On Fire: November 2017 Income Report

Why We Publish An Income Report

This monthly income report is created for you, Fire Nation!

By documenting the struggles we encounter and the successes we celebrate as entrepreneurs every single month, we’re able to provide you with support – and a single resource – where we share what’s working, what’s not, and what’s possible.

There’s a lot of hard work that goes into learning and growing as an entrepreneur, especially when you’re just starting out. The most important part of the equation is that you’re able to pass on what you learn to others through teaching, which is what we aim to do here.

Let’s IGNITE!

**We’ll receive a commission on the affiliate links below. If you click on my affiliate link and sign up for the products and services I trust and recommend, then I will earn a commission.

Josh Bauerle’s Monthly Tax Tip

What’s up Fire Nation, my name is Josh Bauerle. I’m a CPA and the Founder of CPA On Fire, where we specialize in working with entrepreneurs to minimize their tax liability while keeping them in line with the ever-changing tax laws.

I’ve been working with JLD & Kate at Entrepreneurs On Fire for years now, and they’ve included me in these monthly income reports with unlimited access to all their accounts so I can verify that what they report here is complete and accurate.

And because they believe in delivering an insane amount of value to you, my job doesn’t stop at the verification level; I also provide a new tax and accounting tip every month!

Josh’s November Tax Tip:

One of my favorite benefits of entrepreneurship is the flexibility it offers.

And there’s no time I enjoy that flexibility more than the Holidays!

Back when I was an employee, I was extremely limited with when – and how much time – I could take off for the Holidays.

In some jobs, working at least one of the major Holidays each year was a requirement.

But now that I’m my own boss and set my own rules, I can take as much time off as I want!

Of course, if I want to be successful, the work still needs to get done, but how and when it gets done is up to me now :)

But flexibility isn’t the only benefit entrepreneurs can enjoy this time of year. There’s also the opportunity for some unique tax deductions that come up this time of year! And two of them that Kate and I were recently discussing and thought would be relevant to share with Fire Nation are:

1. Buying gifts for clients and/or colleagues, and

2. Throwing business Holiday parties

So, let’s break each of these down!

1. Gift Giving

There are actually some pretty big restrictions when it comes to gift giving.

Generally, the IRS will only allow you to deduct up to $25 per person or company you give to.

This is true whether the gift is for an employee, client or professional associate. So if you send a $50 gift basket to your favorite client (or maybe CPA?!) you will only deduct $25 of that cost on the return.

One major exception would be for actual charitable gifts, meaning they were made to a not for profit organization. The only restriction on deducting these gifts would be that the total amount given for the year can’t be more than 50 percent of your income (and if you are reaching that limit, kudos to you on your extreme generosity!)

2. Holiday Parties

Many business owners, both large and small, will throw some type of Holiday party. Whether it’s for employees, clients, or just people who help you in your business, throwing one of these parties is where you can get a little more creative on the tax deductions.

First, if you’re buying the food/drinks for everyone in attendance, you are no longer limited to the 50 percent limitation on meals and entertainment. You can take the full amount.

This is true whether you hold the event at a restaurant, bar or other outside location (or if it’s at your own home or office).

Second, where you can get really creative is with renting your home to your business to throw the Holiday party.

The general idea here is that your business would pay you rent for the privilege of using your home for the holiday party. And the best part? Because you are renting your home for less than 14 days in the given year, the rent your business pays you is not taxable.

So if your business pays you $500 to rent your home for the party, your business gets a $500 deduction – and you pay no taxes on it!

The key here is to figure out what a reasonable amount of rent is.

My suggestion here would be to call around to some local locations you would rent for something like this – a hotel conference room for example – and document what they quote you.

Then, use the average rate of the quotes you received for the amount of rent you charge your business.

The Holidays are a great time to be an entrepreneur (but really, what time isn’t?!)

We hope these holiday gift and holiday party ideas are helpful in maximizing your tax deductions this season!

As always, please feel free to contact me if you’d like to discuss what would be best for YOUR business. I LOVE chatting with Fire Nation!

David Lizerbram’s Legal Tip

How to Hire a Lawyer for your Business, Part I

Sooner or later, every business is going to need legal representation. A lawyer can either be an expensive line item or a huge asset for your business.

As an entrepreneur, it’s up to you to make that choice.

If you haven’t hired a business attorney before, the process can be intimidating. I know having been hired by hundreds of clients to represent them over the course of my career.

When the client (that’s you) is informed and knows what they’re looking for, there’s a much greater likelihood of having a positive result for both sides – the lawyer and the client.

Ultimately, we both want the same thing: a mutually beneficial, long-term business relationship.

To help you achieve that result, I’ve put together this list for you!

7 Keys to Choosing the Right Lawyer for Your Business

This is Part 1 – be sure to check out Part 2 in our January 2018 income report!

Key 1. Figure out when you need to hire a lawyer

This is going to vary for every client. Generally speaking, the sooner you establish this crucial relationship and start getting good advice, the better off your business is going to be.

However, good legal advice isn’t free. (On the other hand, bad legal advice is easy to find.)

If you’re just starting out, I’d suggest you start contacting business lawyers and asking them what their rates are for basic services like an initial consultation or a business formation.

You can put those numbers into the budget as you get the funds together to start your business – whether it’s a solo, bootstrapped operation, or one where you’re seeking investment capital.

Finally, be sure to hire a lawyer before you do something that’s going to get you into trouble. For example, if you’re forming a partnership, entering into a lease, taking money from investors, or putting a product out there that might create some liability, hiring a lawyer to protect your rights should be a high priority.

Key 2. Focus on the type of lawyer you need

Most business attorneys can handle typical formation needs. This might include creating a corporation or LLC, putting together a partnership agreement, or drafting common business contracts.

- Tip: With all of these, be sure to ask if the documents are being customized to your specific needs.

It’s OK if the lawyer is starting from a template; sometimes there’s no need to re-invent the wheel.

But your lawyer should be doing more than just pressing Print and handing you a document to sign.

If you just need a trademark, or you have a question about tax law, then you can focus on an attorney who specializes in those areas.

But if you’re looking for general, long-term legal counsel for your business, find a business attorney, and he or she can put you in touch with specialists from time to time as needed – whether they’re in the same firm or outside counsel.

Think of your business lawyer like your general practice doctor: you go to him or her for checkups and your regular medical needs; if and when you need a specialist, your general practice doctor will let you know and make a referral.

Key 3. Find a lawyer who understands – or is willing to learn about – your market or niche

This is a followup to Number 2. Yes, you need a general business attorney. But if that attorney has no clue about your industry or how your business operates, there are bound to be communication challenges.

This doesn’t mean that if your company makes green left-handed back scratchers, you need an attorney who only works in the green left-handed back scratcher industry.

It does mean that your legal counsel should have a willingness to learn and understand what your company does every day and who your main customers and strategic partners are. These points should be factored into your legal strategy.

Of course, in the event you work in an industry that’s specialized and highly regulated, you’re probably going to benefit from the advice of someone who understands those regulations. If you’re opening a nuclear power plant, an attorney who is familiar with the complex web of regulations involved in that type of project is going to be the right fit for you.

For most businesses, however, a basic willingness to learn is enough to meet your needs.

Key 4. Pick a law firm of the right size

There are pros and cons to working with big firms, small firms, and solo practitioners.

If your business grows to be the next Facebook, Amazon, or Tesla, you’ll probably be engaging the services of large law firms from time to time. Of course, by that point, you’ll also have your own in-house legal department.

Sometimes – and this is by no means always the case – startups and small businesses find themselves to be a low priority for larger law firms.

If the law firm is really making its money representing Fortune 500 companies, large government entities, and the like, it can be challenging for the firm to be responsive to the needs of every individual client.

Another potential issue with working with a larger firm is the question of who you’re actually going to be working with. Are they going to assign your work to a new associate attorney fresh out of law school?

Is that associate going to be with the firm for the long-term, or will he or she be looking for a new job just when you get used to working with them?

Will your file get passed from one office to the next?

However, there can be advantages to working with larger firms if your business requires the resources the firm can bring to bear.

Very complex lawsuits, for example, may be better suited for a larger firm than a solo attorney or small firm. Sometimes, clients prefer a blended strategy – working with a solo attorney or small firm on a regular, ongoing basis, and using a big firm (typically at a higher cost) for specific, occasional projects.

If your law firm is not willing to collaborate with outside attorneys, that may be a red flag.

- Tip: No matter what size the law firm, be sure to understand up front who you’ll be working with. How do you get in touch with your contact? What’s their availability should an urgent issue arise?

Most firms with multiple attorneys have different hourly rates for each attorney, so that’s an important consideration as well.

If a young associate with a low hourly rate will be handling your matter, will the file also be reviewed by a more senior partner? If so, are you going to be paying that partner’s much higher rate for that time?

Working with small firms or sole practitioners can have its advantages, too.

Typically, you’re going to receive more individual attention. And many solo practitioners establish relationships with other attorneys to act as an informal version of a traditional law firm – meaning, your needs will still be covered if that lawyer goes out of town, or if you come up with an issue that’s outside of his or her areas of specialization.

So, if you decide to go with a smaller firm, make sure it’s one that has access to resources that you’ll need as your business grows.

Which leads me to Key #5…

Be sure to tune in to January 2018’s income report to get Key’s 5 – 7!

If you have a legal question that you’d like me to cover on a future Income Report shoot me an email with your request! I’ll be sure to give you a shout-out when I join John & Kate to talk about your legal questions!

*Bonus* Download David’s FREE Checklist on Intellectual Property for Entrepreneurs!

What Went Down In November

Youpreneur Summit, London

When Chris announced his first annual Youpreneur Summit in London and asked John to keynote the event, we jumped on the opportunity to be involved.

We know that Chris and AMAZING events go together because we’ve been a part of two of his previous Tropical Think Tank events in the Philippines – in 2014 and again in 2015.

The time and care that Chris and his team put into creating an experience for those who attend never goes unnoticed.

As you can tell, we had high expectations arriving in London…

Were they met?

Absolutely.

From start to finish…

- The opportunities to build new relationships – in addition to enhance already-existing ones – were plentiful;

- The mastermind sessions each day provided FOCUS time for brainstorming and problem-solving;

- The presentations delivered a mix of inspiration, motivation and down & dirty actionable steps; and

- The nighttime get-togethers put the icing on the cake.

Top business lessons learned

The recurring theme of the entire event – something mentioned by nearly every speaker who stepped on stage – was this:

The importance of doing things that don’t scale; mainly, having one-on-one conversations with your readers, listeners, prospects and customers.

We all want to automate, scale, grow, gain back time… but we can’t do all of that from the very beginning.

We have to be willing to do things that don’t scale.

Like having one-on-one conversations with your readers, listeners, prospects and customers.

Lessons don’t come up over and over again on accident

If the same message runs through nearly every presentation at an event, then it’s time to listen up.

When’s the last time you had a one-on-one conversation with your readers, listeners, prospects or customers?

I challenge you – today – to put together a schedule that will allow you to spend an afternoon booking these one-on-one calls.

Then, set up a 2-hr block of time where you have 15-minute conversations with individuals in your audience.

You can reach out to them to schedule these conversations via email (anyone who has ever sent you a message telling you they love what you do, or that they enjoyed your last post or podcast episode – that’s a perfect place to start!)

A few other value bombs dropped from the stage?

Use #journorequest

I’m not a public relations pro by any means, but a great lesson from Janet Murray (who IS a public relations pro) is to leverage the #journorequest, which high-level journalists and PR pros use when looking for relevant news and stories to cover.

We all need to be more self-reliant

“You, where you’re headed, your idea – they are enough.”

This came straight from John Jantsch, who made several excellent, simple points about individuals needing to be more self-reliant.

In other words John said, “All the speakers on stage tell you what you could do, but not necessarily what you should do… what you should do is inside.”

Give yourself a little more credit and trust yourself!

And these are just a few of our top business lessons learned at Youpreneur Summit! To check out the rest be sure to head over to this post and episode from the Entrepreneurs On Fire blog!

Other London adventures

While Youpreneur was definitely one of the highlight of our trip, it wasn’t the only thing we had going on in London.

We also took full advantage of being in one of the most incredible cities in the world, which included:

Spending time with the Podcast Websites team, which is 90% UK-based.

This is our amazing lunch at the top of The Shard, recommended by the Mark Asquith himself :)

Attending 3 amazing musicals: Wicked, The Lion King, and Aladdin.

Our favorite was The Lion King because they had the most incredible costumes and so many unique ways to represent the animals and characters!

Taking so many amazing walks through parks and the city itself.

If you’re into walking, then you could do it for hours on end and never run out of amazing places to see in London!

The Churchill War Rooms are a MUST! So much history!

Westminster Abbey, Big Ben, Buckingham Palace… I could go on! None of these stops let us down…

And while it was COLD throughout our stay, the tradeoff is that we got to see the streets and holiday decorations all around us…

Our time in London was so incredible, and it was a prefect cap to our worldly adventures before heading home to Puerto Rico.

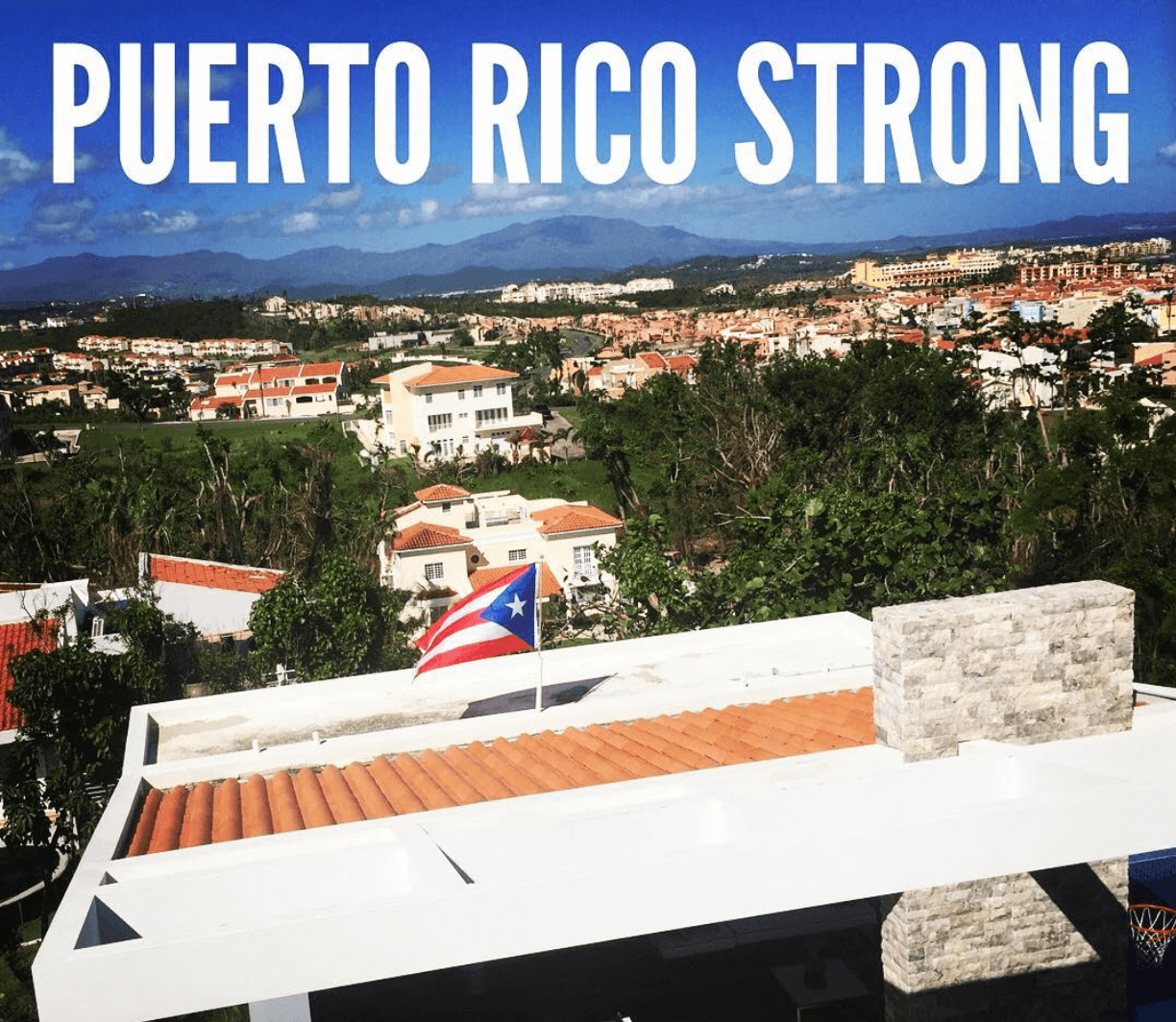

A return to Puerto Rico

On Nov 17th we had a one-way plane ticket from London to Puerto Rico.

For almost the entire month of Oct – and all the way up to Nov 17th – we had spent a significant amount of time brainstorming and researching other places we could travel to prior to our return home.

Since Maria hit, we’ve had a combined 4 canceled flights, and after the 4th we were pretty much set on not returning until power and Internet were back.

Come Nov 17th, we made a tough decision: even though we knew power and Internet wasn’t back, we boarded our flight to return home for the first time post-Maria.

We arrived in Puerto Rico the afternoon of the 18th.

Up to that point everything we knew about the impact and devastation on the island was through text messages, broken-up phone calls, and through our Palmas WhatsApp group that we started with our friends here in the community.

Coming back and actually seeing everything was a whole different experience.

Our drive home and first few days here were interesting – to say the least.

Things that you wouldn’t ever consider on a day-to-day basis suddenly became our reality, and we’re very well aware of the fact that we don’t even have it that bad (some people in the mountains or on the interior of the island still don’t even have running water).

Some examples:

- Nothing looks the same here; leaves have been ripped from trees (and a lot of trees are completely gone), there are downed power lines everywhere, and you see missing windows and roofs on major structures throughout the island. It’s hard to even ‘place’ yourself sometimes when you’re driving around;

- No power = no traffic or street lights; we thought driving in PR was bad before…

- When the sun goes down, it’s DARK; it’s crazy to realize how much light pollution happens without us even realizing it.

It’s heart-breaking to hear that many homes on the island still don’t even have running water, and while there are some restaurants and stores open, many of the places we were used to going to for basic necessities are still closed – and may not ever open again.

Returning to Puerto Rico has brought with it much responsibility:

- Cleanup and starting to put our house back together is a daily focus;

- Communication is minute-by-minute; sometimes we can make calls and send text messages, and other times we can’t;

- Gaining Internet access has not been easy; just last week we drove 1.5 hours to San Juan to find out the co-working space we had rented just lost all power and Internet. Luckily their sister office about 30 minutes away was still up and running.

As you can see, Hurricane Maria has brought us a lot of challenges; but she’s also brought us perspective.

More on that at the end of this post, in our Biggest Lessons Learned section :)

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

November 2017 Income Breakdown*

Product/Service Income: $116,768

TOTAL Journal sales: 589 Journals for a total of $23,022

The Freedom Journal: Accomplish your #1 goal in 100 days!

- TheFreedomJournal.com: $2,183 (46 Hardcovers & 12 Digital Packs sold!)

- Amazon: $11,505 (307 Freedom Journals sold!)

- Total: $13,688

The Mastery Journal: Master Productivity, Discipline and Focus in 100 days!

- TheMasteryJournal.com: $1,105 (20 Hardcovers & 9 Digital Packs sold!)

- Amazon: $8,229 (216 Mastery Journals sold!)

- Total: $9,334

Podcasters’ Paradise: The #1 Podcasting community in the world!

- Recurring: $23,955 (240 monthly)

- New members: $10,980 (50 new members)

- Total: $34,935

Podcast Sponsorship Income: $53,500

Podcast Websites: $5,000

Skills On Fire: $92

Podcast Launch: Audiobook: $168 | eBook: $51

Free Courses that result in the above revenue:

Your Big Idea: Discover your big idea in under an hour!

Free Podcast Course: Create and launch your own podcast!

Funnel On Fire: Create a funnel that converts!

Affiliate Income: $92,203

*Affiliate links below – if you click on my affiliate link and sign up for the products and services I trust and recommend, then I will earn a commission.

Resources for Entrepreneurs: $59,246

- Audible: $352

- BlueHost: $600 Step-by-step guide and 23 WordPress tutorials included! Disclaimer: This is my affiliate link and I will receive a commission if you sign up through my link

- Click Funnels: $41,371

- Coaching referrals: $750 (email me for an introduction to a mentor for overall online business or a Podcast focused mentor!)

- Mentorship: $15,000

- ConvertKit: $133

- Disclaimer Template: $198 (legal disclaimers for your website)

- Fizzle: $128

- LeadPages: $714

- Infusionsoft: $0

Courses for Entrepreneurs: $31,203

- Create Awesome Online Courses by DSG: $5,529

- Webinars that convert by Amy Porterfield: $436

- 10k Readers by Josh Turner: $94

- The Amazing Seller by Scott Voelker: $396

- 10k Subscribers by Bryan Harris: $98

- Copywriting Academy by Ray Edwards: $1,058

- Self Publishing School by Chandler Bolt: $698

- Author Audience Affluence by Richie Norton: $20,000

- ASK by Ryan Levesque: $2,894

Resources for Podcasters: $922

- Pat Flynn’s Fusebox Podcast Player: $49

- Podcasting Press: $0

- Libsyn: $800 (Use promo code FIRE for the rest of this month & next free!)

- UDemy Podcasting Course: $73

Other Resources: $832

- Amazon Associates: $549

- Other: $283

Total Gross Income in November: $208,971

Business Expenses: $51,101

- Advertising: $2,438

- Affiliate Commissions (Paradise): $3,435

- Accounting: $350

- Cost of goods sold: $2,535

- Design & Branding: $1,980

- Education: $34

- Legal & Professional: $630

- Meals & Entertainment: $1,216

- Merchant / bank fees: $5,944

- Amazon fees: $5,764

- Shopify fees: $49

- PayPal fees: $199

- Office expenses: $223

- Payroll Tax Expenses / Fees: $1,581

- Paradise Refunds: $5,430

- Total Launch Package fees: $175

- Sponsorships: $9,750

- Show notes: $364

- The Freedom & Mastery Journal: $0

- Travel: $3,948

- Virtual Assistant Fees: $3,632

- Website Fees: $1,424

Recurring, Subscription-based Expenses: $3,274

- Adobe Creative Cloud: $100

- Boomerang: $70 (team package)

- Brandisty: $24

- Authorize.net: $91

- Cell Phone: $173

- Google: $45

- Internet: $380

- eVoice: $10

- Infusionsoft CRM: $396

- Insurance: $551

- Libsyn: $400

- Manychat: $65

- Chatroll: $49

- PureChat: $20

- ScheduleOnce: $9

- Skype: $3

- Shopify: $176

- Stripe: $5

- TaxJar: $19

- Workflowy: $5

- MeetEdgar: $49

- Taxes & Licenses: $300

- Try Interact: $89

- Zapier: $15

- Zencastr: $215 (annual fee)

- Zoom: $15

Total Expenses in November: $54,375

Payroll to John & Kate: $15,900

In our May 2014 Income Report and our June 2016 Income Report, Josh focuses on how to pay yourself as an entrepreneur. Check them out!

Wondering what we do with all of our net revenue? We share all in our April 2017 Income Report :)

Total Net Profit for November 2017: $154,596

Biggest Lesson Learned

Putting things into perspective

Life isn’t always easy.

Neither is running a business.

Things come up that you didn’t expect; you face financial challenges at the worst possible moments; relationships with your friends and family hit rocky patches.

But I’m sure you can agree: you’re pretty darn lucky to be in a position to create an opportunity out of what might seem, in the moment, like something very annoying and inconvenient.

To be able to:

- accept challenges – even when you don’t expect them;

- offer up your services in order to earn money – even when you’re fielding overdraft charges from your bank;

- simply have relationships with your friends and family – even if they need repairing.

Last week we returned to our home in Puerto Rico for the first time post-Hurricane Maria.

Hurricane Maria has done a lot of damage.

- She has destroyed entire islands;

- She has left countless numbers homeless;

- She has taken the island’s power;

- She has also taken a lot of lives.

- Something else Hurricane Maria has done:

She has put things into perspective.

You’ve probably experienced a life event at some point that really put things into perspective for you, too.

Hopefully you carry that lesson with you, and when you think about the fact that life – or running a business – isn’t easy, you’ll be thankful – you’ll feel lucky – that you’re in a position to create an opportunity.

Alright Fire Nation, that’s a wrap!

Until next month, keep your FIRE burning!

~ Kate & John

Note: we report our income figures as accurately as possible, but in using reports from a combo of Infusionsoft & Xero to track our product and total income / expenses, they suggest the possibility of a 3 – 5% margin of error.